Transfer

The Make Transfers feature can be used to transfer funds between accounts on the Transfer Money screen. You can initiate a new fund transfer to your own account in the same bank, recipients in the same bank, recipients in other banks that you have added, recipients in international banks, to P2P recipients, and wire transfers.

Menu path: Web Channel > Payments and Transfers > Transfer Between Accounts

On the top bar, click Transfers and then click Transfer. The app displays the Send Money screen.

Menu path: Mobile Native > Transfers

The app displays the Transfer From screen.

Funds can be transferred to eligible accounts only. Eligibility is decided by the account type maintained by the bank and is controlled from the core banking system.

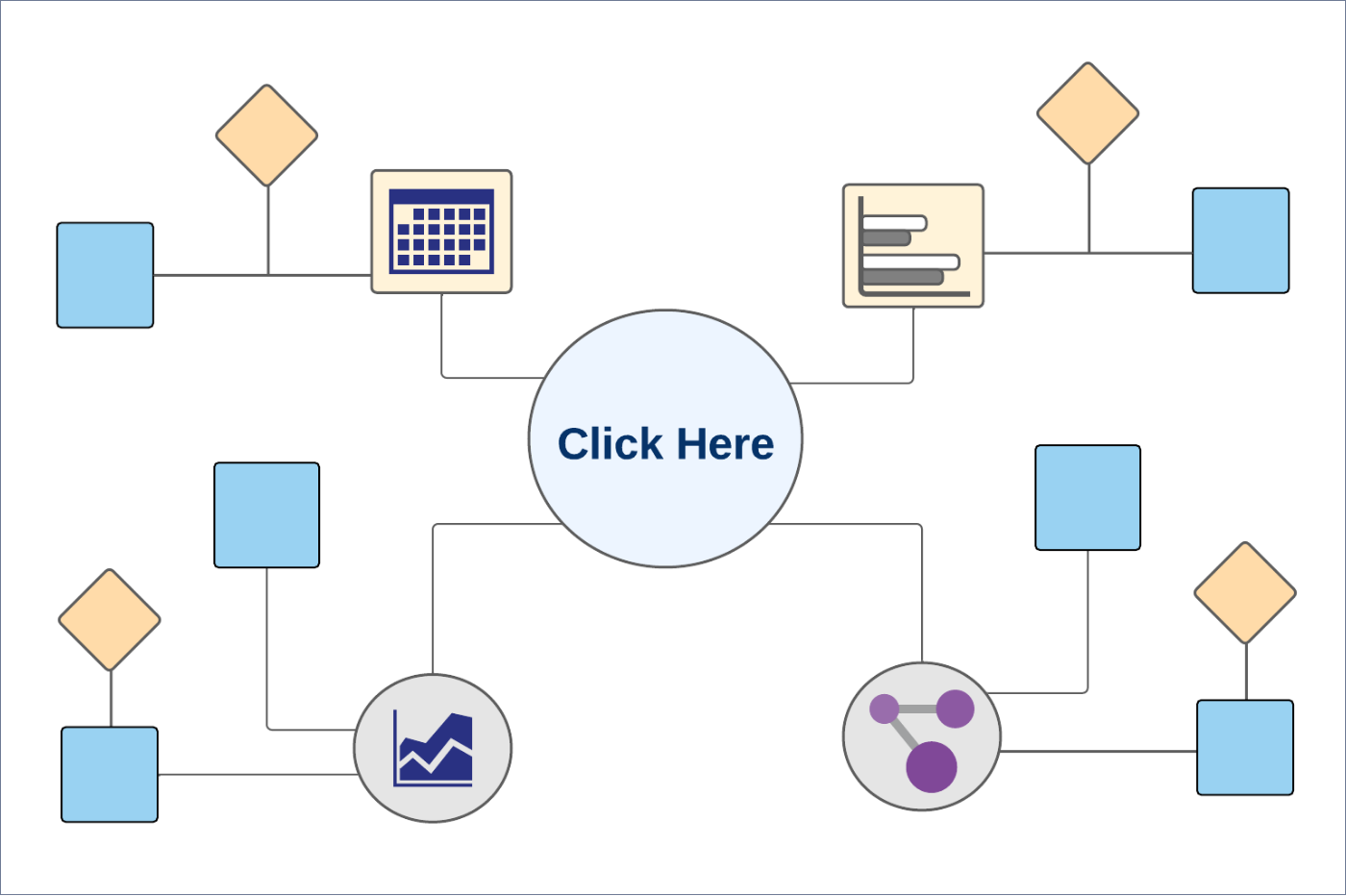

Business Process Diagram - Transfer

Make Transfer

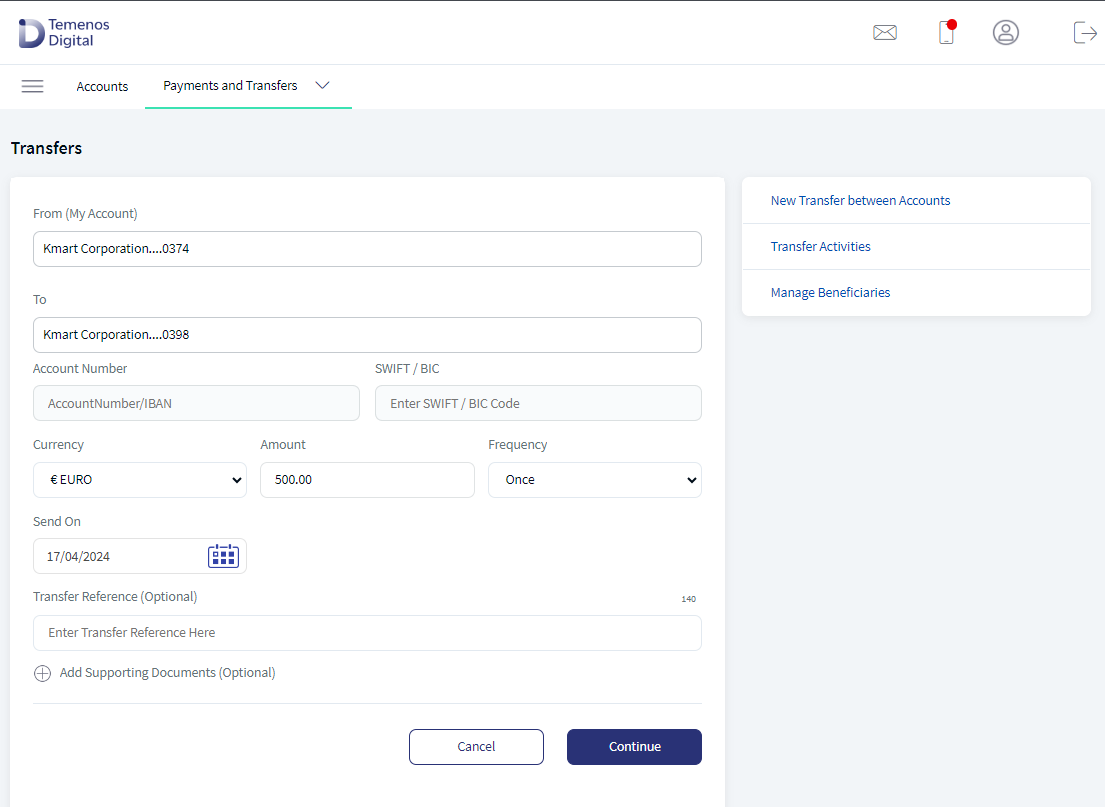

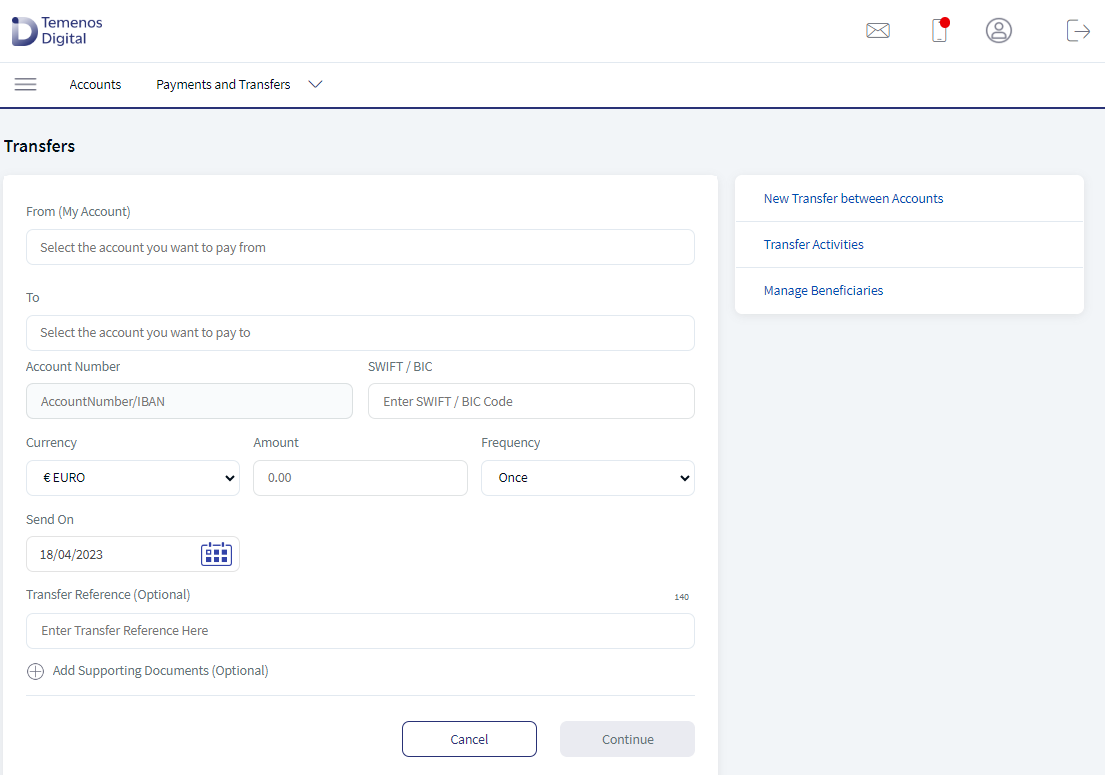

Use this feature to transfer money. The frequency option provides the user to make different types of money transfers. The quick section helps the user to navigate to desired pages. The user can see the quick links only in desktop mode. The following is the procedure to make transfer:

- Transfer From. Select an account from the list. Only eligible accounts are displayed in the list. The app displays an appropriate message if the list is empty.

There is no default transaction account auto-populated for From account. It is mandatory to select the From account to perform a transfer.

- Transfer To. Select the account from the list. Only eligible accounts are displayed in the list. The app displays an appropriate message if the list is empty.

The list of eligible P2P recipients are also displayed in the list. Select a P2P recipient to perform a P2P transfer.You can also make a transfer to your loan account. The list of loan accounts are displayed. Select the loan account to perform a transfer.

- Amount. Enter the amount to be transferred.

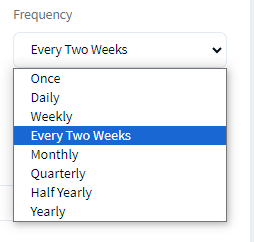

- Frequency. Select the frequency from the list. User can make this to a scheduled or recurring transfer.

- For schedule transaction,

- In Frequency, select once.

- In Send On, select the date. The can should be greater than or equal to current date.

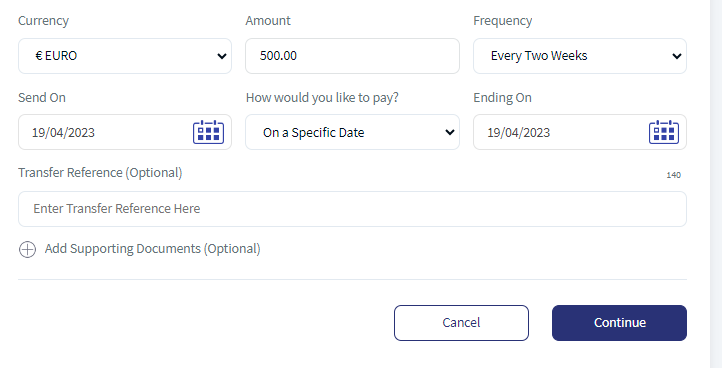

- For Recurring transaction,

- In Frequency, select any of the following.

- Daily

- Weekly (every 7th day from the selected start date)

- Every Two Weeks (every 14 days from the selected start date)

- Monthly (every month on the selected date, cannot select 31st of the month in this case)

- Quarterly

- Half Yearly

- Yearly

- In How would you like to pay?, select

- Specific Date. The user needs to provide Start Date and End Date.

- In Frequency, select any of the following.

- For schedule transaction,

- Notes. Add notes if required.

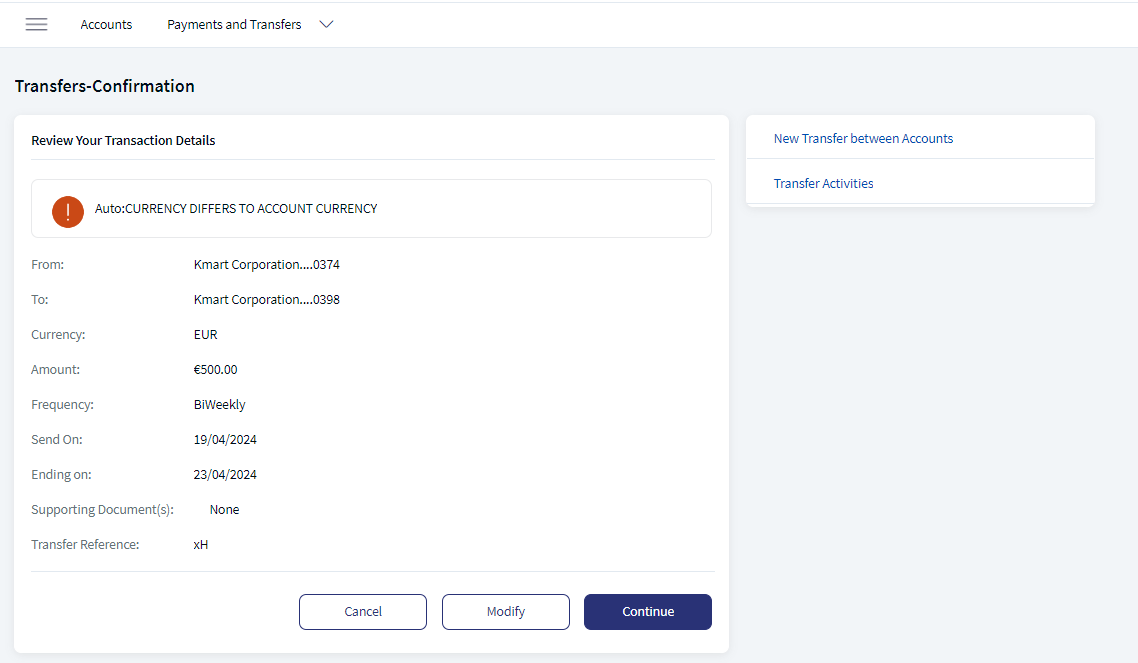

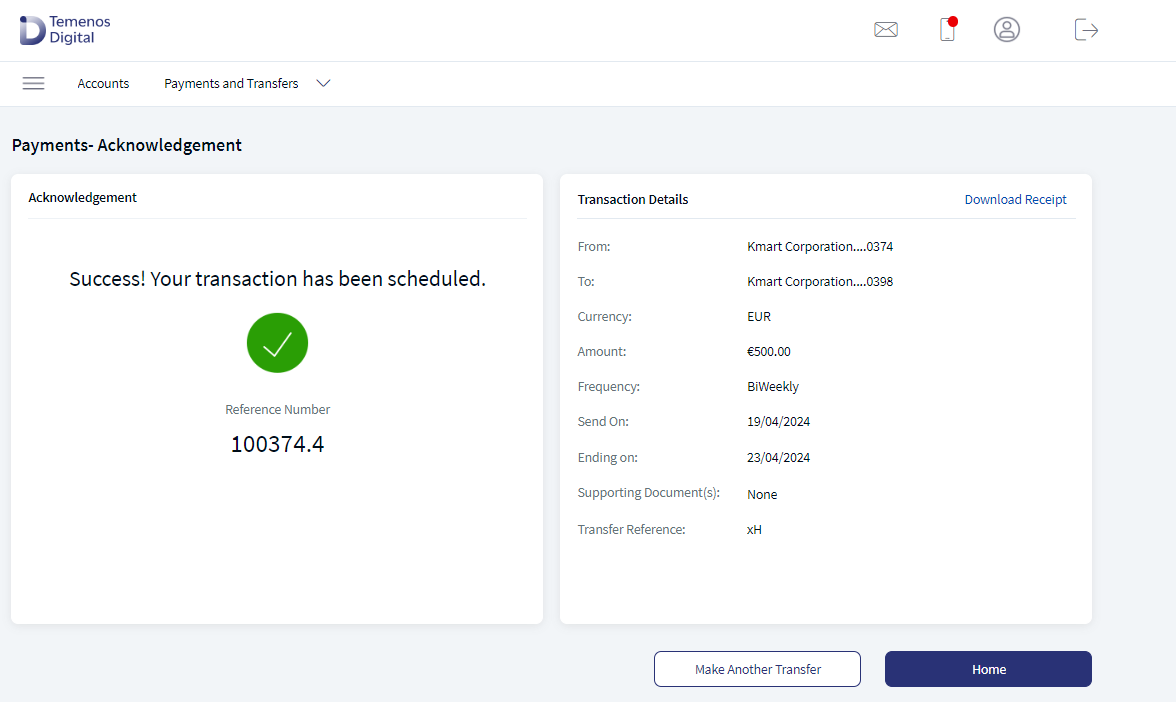

- Click Continue. This navigates to Transfers - Confirmation page.

- Verify the details and Click Confirm. This navigates to Acknowledgment page.

The app displays the acknowledgment screen with transaction details, unique reference number to the transaction, and provision to navigate to Make New Transfer, Accounts (Dashboard), and print the acknowledgment screen.

- Depending on the bank configuration, if Strong Customer Authentication(SCA) is enabled for the feature, SCA is triggered. The authentication type is configured and can be turned on or off in the Spotlight application. For more information see Push Notification.

- The authentication type and the threshold value for transferring the money are configured in the Spotlight application.

- If the transfer fails due to some reason (for example, if you have insufficient funds in the selected account), the app displays an alert along with an appropriate message.

- If the session is timed-out during a transfer and leaves the window open, you have to initiate the transfer again.

Error and Validations

- When the transfer to a loan is initiated, the next due amount is pre-filled in the "Amount" field. You cannot modify the due amount.

- The Bank/FI's can add a limit on the number of transfers or maximum amount that can be made/transferred to a loan account in a month.

- The payment may not be reflected immediately in the loan details or transaction section. It may take 2-3 business days to be reflected in your loan account.

- If the "From" account does not have the enough balance to make the payment, the following message is displayed, "Your account balance isn't sufficient to make this payment.

- In case the due amount is zero, the following message is displayed, "Currently there are no pending dues on your account".

- In case the selected date is later than the "Next Payment Date" associated with the loan account, the following message is displayed "The scheduled date is later than the due date. Making payments after the due date may incur penalty. Do you wish to continue?"

- You cannot make a payment more than the total over due amount. If you select "Pay Other Amount" and enter the overdue amount, the following message is displayed "Your account balance isn't sufficient to make this payment."

Configuration

Backend Integration - Transact/MS/Mock

Using the runtime configurable parameter (Payment_Backend server property) at the Micro App level, an implementation team can configure the backend integration endpoint as Transact, or Mock as per customer needs for the following. The Payments Fabric MA supports the integration.

- The backend integration for all the APIs is mocked (DBX DB) or SRMS based on customer needs.

- The validations are avoided if the module is directly integrated with Transact endpoints.

- When records are created, use these options: Use the DBX DB table records that already exist, or use the Fabric Java layer to build a stubbed or JSON data response directly.

Follow these steps:

- Sign-in to your Fabric console.

- From the left pane, select Environments.

- For your Fabric run-time environment, click App Services.

- Navigate to Settings > Configurable Parameters.

- On the Server Properties tab, go to

PAYMENT_BACKENDField Name and set the Field Value depending on the integration (for example, MOCK or SRMS or SRMS_MOCK). - Click Save.

Current Transfers is via SRMS, as per the requirement, configuration name and configuration values should be as following:

| Module | Configuration name | Config Possible values |

|---|---|---|

| Payments | PAYMENT_BACKEND (Existing) | SRMS/STUB/T24 |

| Standing Orders | PAYMENT_BACKEND (Existing) | SRMS/STUB/T24 |

In this topic